CPA Scaled Score

What is the CPA Scaled Score and what score do I need to pass my exam?

Why are Scaled Scores used by CPA?

Because CPA Australia uses multiple exams for each subject – it is necessary for scaled scores to be used to measure student performance. Scaled scores ensure fair and equivalent results are awarded to each student – reflecting the level of difficulty in the version of the exam completed.

For example, a student achieving 50% in a very hard version of the exam may achieve the same scaled score as a student achieving 60% in an easier version of the exam.

Each semester, there is a very large cohort of students completing the CPA, which provides plenty of data points for CPA Australia to appropriately calibrate the exam grading process. If you found an exam very hard, it is likely that other students did to, and your result will be calibrated accordingly.

So, what is the pass mark?

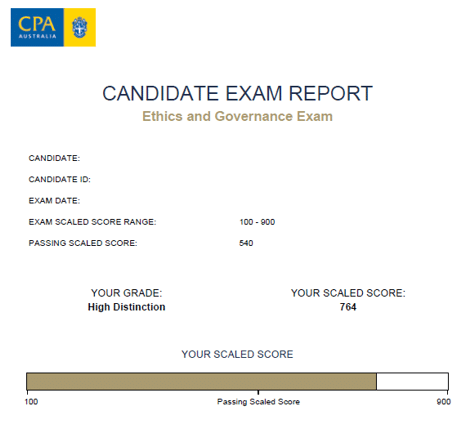

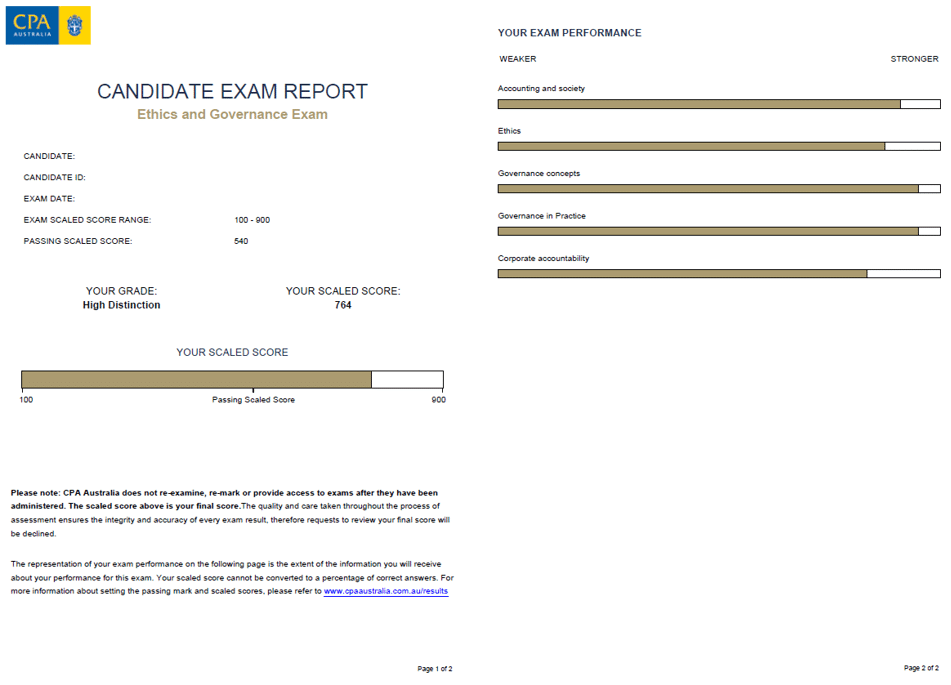

The pass mark for CPA exams is a scaled score of 540. This is a score within the range of 100 to 900 set by CPA – it is very important not to confuse this score with being equal to 60% (= 540 / 900).

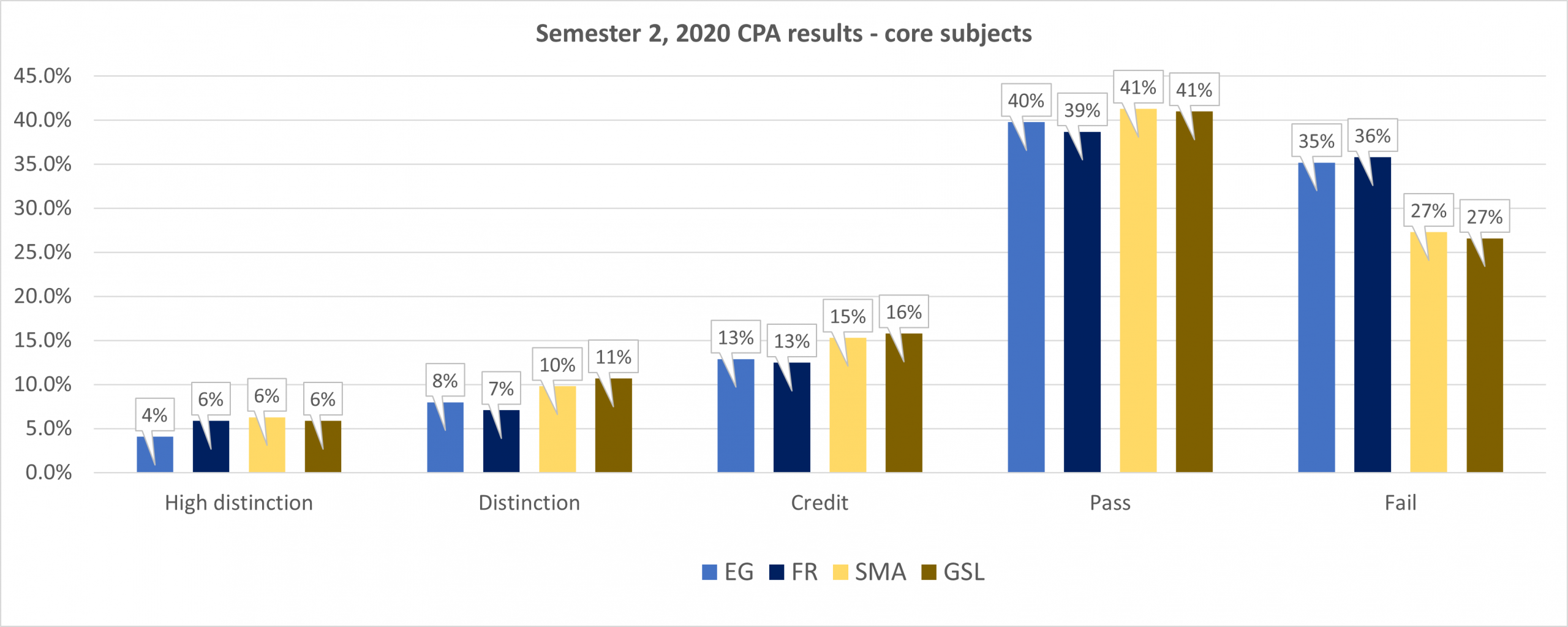

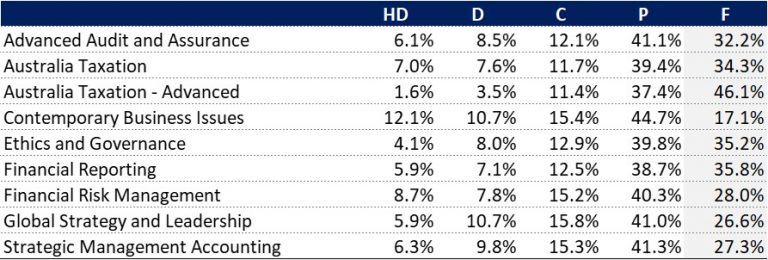

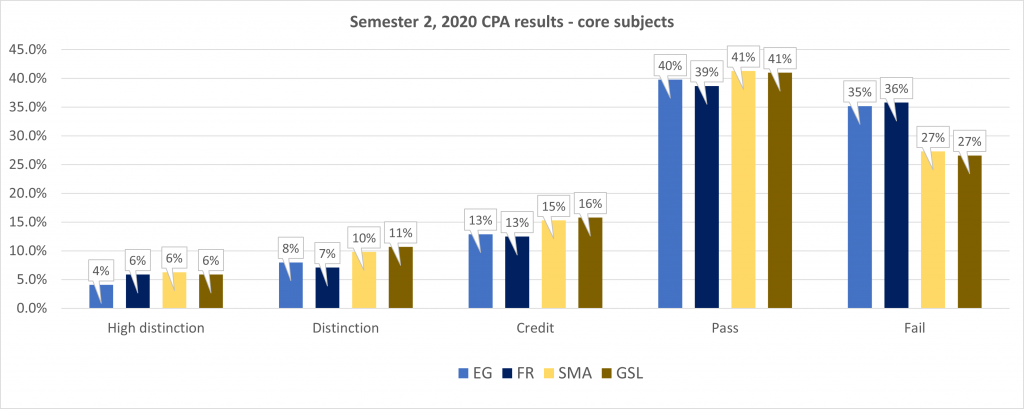

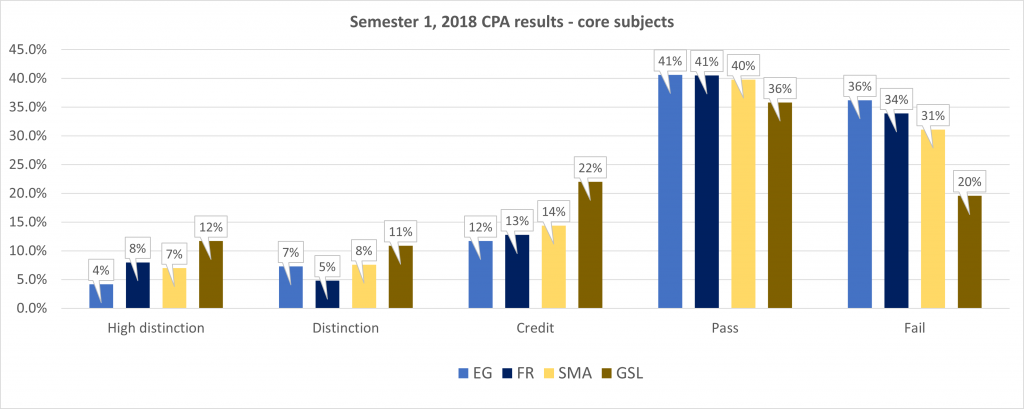

This scaled score is designed to reflect the minimum competency level for the subject being completed. As CPA Australia has the responsibility of ensuring all members carrying the CPA Australia designation have a certain level of understanding of the relevant content, the standard set is high. No doubt, this perspective helps explain the high fail rates across the CPA Program (you can read more about that here).

The Candidate Exam Report received by each student reinforces this message around competency. The second page of the Exam Report shows the relative competency demonstrated by the student for each module of the relevant subject. This enables candidates to understand their areas of strength and weakness and how their performance in each module influenced the overall exam result.

What does the Candidate Exam Report look like?

If you have any queries on the CPA scaled score or would like to discuss your recent exam results, please get in touch via email!